Entering adulthood means no longer stressing about grades and receiving report cards, right? Err, sorrys but no.

Enter: the credit score. Just like college acceptance committees judge your high school GPA, a credit score is the way financial institutions judge your credit worthiness.

What is a Credit Score?

Credit scores essentially are your high achieving, school-girl nightmares following you into financial adulthood. Your credit score tells lenders how trustworthy and responsible you are at handling debt. It takes a couple of factors into consideration:

- Credit history: If you have never had a loan or a credit card before, your credit score is likely not great. Your first credit card can be hard to get if you don’t have any other credit to your name, like student loans, a mortgage, or car payment.

- Payments history: Do you pay your bills on time? Have you ever defaulted on a loan? Lenders want to know the dirt on your financial history.

- Credit utilization: So you have a credit card – how much do you use it? Look at your card’s credit limit – aka the max amount you can charge on the card – and divide by your total monthly charges. That is your credit utilization ratio. To keep a healthy credit score, maintain a ratio under 30%. If you recently got a pay bump (yahoo!), go online or call your credit card to see if you can increase your credit limit and give yourself more room to (responsibly) play.

- Types of credit: How many debt sources do you have? These are things like student loans, mortgages, credit cards, or auto loans.

- Total debt levels: How much debt are you responsible for paying each month?

- Hard credit inquiries: Think social media stalking an ex. Debt lenders will pursue hard credit inquiries whenever you apply for a loan or credit card to dig up details on your credit history. They minorly impact your credit score (about 5 points). Unlike the ex-stalking, you must provide consent before a lender can run a hard credit inquiry on you. When you apply with multiple lenders for a loan, credit score companies will combine all inquiries as one request – called deduplication – so your score doesn’t get shredded with every application.

Credit scores range from 300 to 850. A good credit score typically falls between 700 to 800. Over 800 signifies “excellent.” Aka A+ and a gold star.

Who Makes the Rules?

FICO and Vantage both distribute credit scores. The main credit bureaus Experian, Equifax, and Transunion use VantageScores. (You may be familiar with Equifax from their security leak in the summer of 2017.)

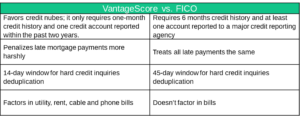

FICO and VantageScores use the same rating system (300 to 850) but there are a couple of differences:

Nobody likes a grade-grubber (ahem, guilty), but sometimes you got to do what you got to do, right? Thankfully, with credit scores, it’s less sucking-up and more good behavior. Plus, you don’t even have to study.

5 things to Help Your Credit Score

1. Pay bills on-time

It’s kind of a duh piece of advice, but a lot of people still mess it up. Paying bills on time makes you an A+ citizen in the credit score formula.

2. Simmer down that credit utilization ratio

Spending half or more of your credit card limit? I know racking up credit card reward points feels amazing, but your credit score’s a killjoy. Charge 30% or less of your credit limit on one credit card. So if your credit limit is $5,000, you should be charging $1,500 or less. And always remember to pay your balance in full every month.

3. Don’t open and close credit cards quickly

Ever open a credit card with your favorite retailer purely for the discounts they promise? While it’s fine to have another credit card (as long as you don’t open a bunch at once), you also shouldn’t close a card immediately after opening. It’s not like buying one month of HBO to binge Game of Thrones. The longer you have a card, the stronger your relationship with credit looks to lenders.

4. Build Debt Lines

Wait, what? How does that make sense?

Your credit score looks at your credit history. To have history, first, you must build trust in your relationship…with debt. Whether it be a credit card, student loan or something else, taking on a line of credit and paying the bills on time show offs your adulting prowess to credit bureaus.

5. Patience, Grasshopper

Credit takes a while to build. If you’re new to building debt lines, give it time. Maintain your open accounts and pay your bills promptly. Stick to the 30% or less credit utilization rule.

RECAP

Childhood never really goes away. Report cards shape-shift to credit scores, aka a number that rates your debt-holder responsibleness on a scale from 300 to 850.

- A score of 700 to 850 means you’re keeping the apple plenty shiny

- Credit nubes will start with low scores because history matters

- To get a good grade (er, score):

- keep your credit card accounts open for a while

- pay your bills and loans on time

- don’t carry a credit card balance from month to month

- use 20% or less of your total credit card limit

Boom! That’s everything you need to hit the debt honor roll.