People don’t want to wait until retirement to start having fun. They want to enjoy life NOW.

But retirement has gotten a bad rap lately. People who work until they’re 65 and then *poof* retire, are viewed like they wasted the best years. Is 65 old? (Asking for a friend.)

Even if you don’t plan to “retire” in the traditional sense, and plan on being your wild, loving-life self all the way until the end, saving for retirement can still help you out. Think of retirement saving as simply money in a tax-sheltered account.

Retirement Saving Accounts

There’s some confusing lingo around retirement saving accounts. It involves a lot of acronyms and things in parentheses. Let’s break this shiz down.

For Workers

401(k)

Who will Use: salaried workers of for-profit corporations

Yearly Limit: $18,500 for 2018 ($24,500 if you’re over 50). Pre-tax money.

You get this when you get the #adulting job. Some companies offer to match contributions with their 401(k) programs, meaning for whatever percent of your paycheck you contribute – capped off at some percentage – they will put in the same amount. Example: if you put 6% of your monthly paycheck towards retirement, your work will do the same. Aka free money for you!!

The catch: Not really a catch, but some companies require you to work there for a certain time period before you can collect their contributions. This is called vesting.

403(b)

Who will Use: Non-profit workers, public school employees, cooperative hospital service orgs, certain ministers

Yearly Limit: $18,500 for 2018 ($24,500 if you’re over 50). Pre-tax money.

Has the same match contribution program as 401(k). 403(b) accounts have cheaper admin costs, so businesses on the lower income side use them. One major difference between 403(b) and 401(k) is 403(b)s allow employees who have worked somewhere for over 15 years to add another $3,000 to their yearly contribution. #dedicationpays

For Entrepreneurs/Freelancers

SEP IRA

Simplified Employee Pension. Allows employers to nest-egg money away for themselves and their employees.

Who Will Use: SEPs can be a good option for entrepreneurs or small businesses. For businesses with employees, with a SEP IRA, those employees can’t contribute to their account. Only the employer has that power.

Yearly Limit: Limited to contributions of 25% of employee’s pay or $53,000 (whichever is smaller). For self-employed peeps, the contribution limit is 20% of income. All pre-taxed money.

Solo 401(k)

Who Will Use: People who are both the worker-bee and the boss. They can contribute earnings as the employee, just like a regular 401(k), plus turn around and match those contributions as the employer. Talk about wearing multiple hats.

Yearly Limit: $18,500 in 2018 as the employee. Plus 25% of income as the employer (Who are the same people in this situation.)

What’s different: The solo 401(k) is choose your own adventure, tax-wise. You can either contribute pre-tax income or set it up as a Roth 401(k) and pay the taxes now, instead of later.

For Regular Guys

Roth IRA

Who will Use: Anyone expecting higher income (and taxes) later in life and wants to pay the taxes upfront.

Yearly Limit: $5,500, post-tax monies only. If you make over $135,000 a year as a #singlelady, or $199,000 as a married person, you can’t contribute.

The cool thing about the Roth is you can take out your contributions without penalty at any time.

How this works: Fiona put $5,500 into her Roth every year. After ten years, her account has $75,000 in it because she made money on an S&P 500 index mutual fund. She wants to take out money to buy a new car, so she takes out $30,000. Because $55,000 of the $75,000 is her contribution money (5,500 x 10 = 55,000), she can take out that $30,000 and not pay a penalty.

Traditional IRA: Individual Retirement Account

Who Will Use: Anybody can open a Traditional IRA. It works like a Roth except it only takes pre-tax money. So you pay lower taxes the years you put money in your traditional IRA.

Yearly Limit: $5,500. If you have a Roth and traditional IRA, you can only put in $5,500 a year – total – between the two accounts.

Note: With both Roth and Traditional IRAs, you can have these in addition to an employer provided 401k. So if you’re regularly hitting the yearly maximum deposit limit on your 401k, you might want to think about opening another retirement account.

Summary

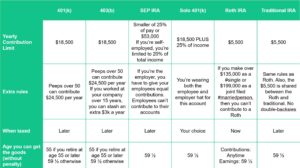

A handy table covering all these accounts at a glance:

Old Age or Just Older?

Retirement isn’t that fun to think about because it’s something that happens when you’re old. But what if you could retire when you’re 40, not 65? Well, start early, store up enough in that retirement account, and it could happen. There are plenty of people out there doing it.

Whatever your plans, best to start nesting some money away for retirement. Your elderly self will thank you.

All we know is when we’re old, I want to be like this.