Fiona and Trish go out to dinner. Trish glances at the menu and dismissively hands it back to the waiter.

“Please just bring me ETF.” The waiter stares at her blankly. “Everything that’s fresh.”

Fiona hands back her menu with a smile. “I’ll have everything that’s fried. That’s my ETF.”

Are you a Fiona or Trish?

Sadly, we’re not discussing either of those ETFs here. We’ll be focusing on a much less edible ETF. Exchange-traded fund.

ETFs try to copy the performance of certain indices, countries, commodities, or entire industries. For example, if gold prices are increasing, a gold ETF would (likely) also increase.

Break it down

Let’s explain the acronym.

Exchange: Not like after-holidays returns. Exchanged refers to a market-place where things (like stocks) are constantly being bought and sold. Think New York Stock Exchange.

Traded: Can be bought or sold any time the market is open.

Fund: Some people get together and pool their money to buy things and share the ownership. Like when friends rent an expensive beach house together that they could never afford alone. This also means if you own an ETF, you reap the returns, like dividends. Owners of ETFs can sell at the market price any time – just like an individual stock.

IRL Example: Mr. Spider

So, an ETF is when a bunch of people put their money together to buy some things (assets) and then distribute ownership shares that can be bought or sold in a marketplace (like a stock exchange) at any time.

How do they do this?

Let’s look at an ETF example. This is a real ETF you could buy right now.

SPDR, nicknamed Spider. Ticker is SPY

What is it? It’s a sneaky S&P 500 copycat

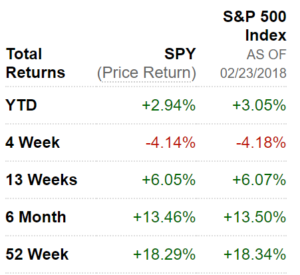

The Spider fund buys shares in all the stocks contained in the S&P 500 index. Since the market (which is really a bunch of humans) values each company differently – known as market capitalization, or market cap for short – Spider holds different percentages of each company, depending on the size of the company’s market cap. But in general, it will track the S&P’s performance pretty closely, as the above chart shows.

You probably recognize a lot of SPY’s major holdings, since they’re the same as the ones in S&P 500, which tracks 500 companies with the largest market capitalizations that trade on the New York Stock Exchange.

As you can tell, SPY’s not a perfect match. But like a good knock-off designer bag, it does the job.

Cut to the Chase

ETFs can help you show love to more stocks. Instead of buying lots of stocks individually, you can buy an ETF and get a small ownership of lots of different stocks. Diversification FTW.

If you want to invest in the Chinese economy, you could buy an ETF that invests in lots of major Chinese companies.

If you want to invest in oil, you could buy an ETF that mirrors oil prices.

There’s even an ETF that tracks Bitcoin.

For lots of different investment ideas, there’s probably an ETF replicating that market or industry.

RECAP

ETF: Stands for Exchanged-Traded Fund

Definition, please: Security that’s traded on an exchange (like the NY Stock Exchange) and tracks the performance of certain indices, industries, bonds, commodities or even entire economies.

Why use: Can be a great way to easily diversify where you put your money

Later on, we’ll take a closer look at ETFs when we compare them to their cousin mutual funds.

One big happy investment security family! <3