Mutual funds and ETFs are brothers in the investment securities family.

Time for a cousins anecdote.

Trisha and Fiona are grabbing brunch at their favorite spot. It has outdoor seating, bottomless drinks, and serves omelets the size of steering wheels.

That’s a lot of eggs!

They spot two guys sitting near them, also eating brunch. Trisha speculates on their relationship. Friends? Partners? Dating? Brothers?

“They look oddly similar,” Fiona observes.

The waitress comes over and notices their staring. “Those are the Fillmore Cousins,” she says. “They started that high-end calzone bakery everyone’s talking about.”

“Of course. Cousins,” Trisha says.

Cousins. Sometimes they’re your best bud who you start a business with. Sometimes they’re the people who beat you out for the best grandchild award. Either way, they’re family.

Some investment cousins: Mutual Funds and ETFs

How’d ya like that segue?

MFs and ETFs have a lot in common. They both:

– Sell shares of ownership to underlying assets in a fund

– Help you diversify your green $$

– Try to copy benchmarks, industries, or certain economies’ performances

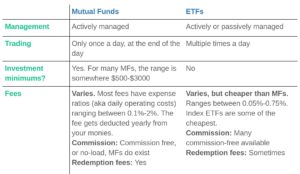

However, they’re cousins, not siblings, for a reason. Their parents had different life philosophies. Some differences:

A Word About Dem Fees

There’s a lot of confusing jargon around mutual fund and ETF fee structures. Here are some useful tidbits:

Front-load: When there’s a commission fee for buying

Back-load: When there’s a commission fee for selling

No-load: Yay, no commission!

Redemption fee: Penalty for being flaky and selling too soon after you bought. SEC limits these fees to be 2% or less

Expense ratio: Fancy term for operation costs. Subtracted annually from your holdings. What does this pay for? Things like salaries, advertising, distribution, legal. Typically lower for ETFs (because passive management).

12-b1 Fees: Included in the expense ratio. Covers advertising and distribution costs.

Purchase Fee: Fee when you buy. Sounds like front-loading? It’s the same idea! Except the fee goes to the fund, not a broker.

Account Fee: Penalty for when you have less money in your account than they require

RECAP

Mutual funds and ETFs are same same, but different. Key differences: active/passive management, fees, investment minimums, and how often you can move your money in and out of them.

Both can help you achieve investment success, depending on your goals and the type of account you’re using to invest your money. And both will go up and down as the underlying assets rise and fall.